Understanding the UK Tax Code: Deciphering the Numbers

-

Navigating the UK tax system can feel like deciphering a secret code, especially when it comes to understanding your tax code number. But fear not, we're here to demystify the numbers and letters that make up your tax code.

Let's focus on the numbers in your tax code. These digits hold important clues about your tax situation.

Here's a breakdown:

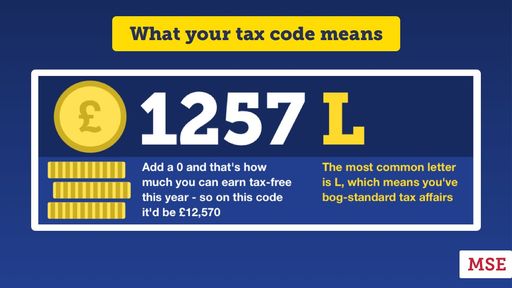

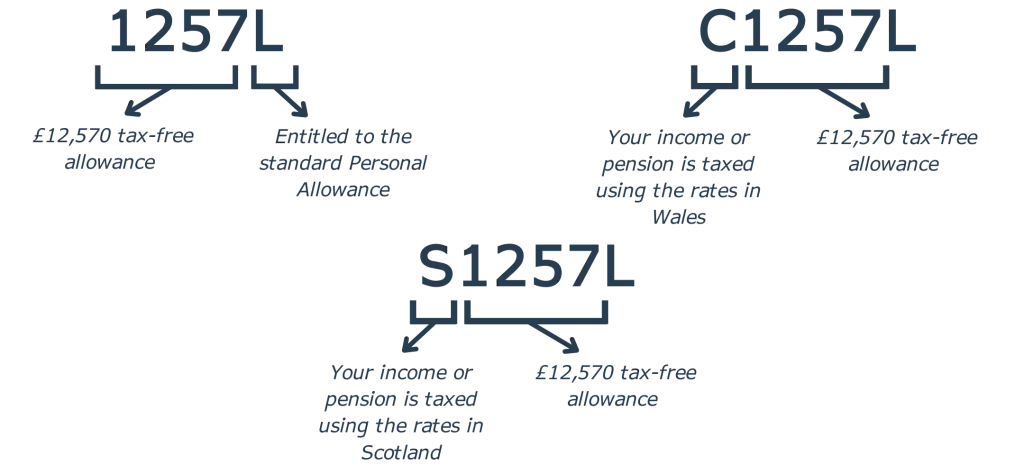

image: farsightfinance.co.ukPersonal Allowance: The most crucial number in your tax code is your personal allowance. This represents the amount of income you can earn before you start paying tax. For example, if your tax code is 1250L, the number 1250 is your tax-free income allowance.

Additional Information: Sometimes, the numbers in your tax code may indicate specific deductions, allowances, or adjustments to your tax situation. For instance, the number 0T may mean that you have no personal allowance, and all your income is taxable.

Emergency Tax Code: If your tax code includes the number 0T, it means you're being taxed at the basic rate without any personal allowance. This might happen if you haven't provided your employer with a P45 form from your previous employment.It's crucial to review your tax code regularly to ensure it accurately reflects your circumstances. Any errors in your tax code could lead to underpayment or overpayment of tax, impacting your finances.

Understanding your tax code numbers empowers you to stay informed about your tax situation and make informed financial decisions. If you're unsure about your tax code, seeking professional advice can help you avoid potential issues with tax payments in the future.

In a nutshell, your tax code numbers hold the key to understanding your tax situation. By decoding these numbers, you can ensure that you're paying the right amount of tax and avoid any surprises come tax time.

more reading : link